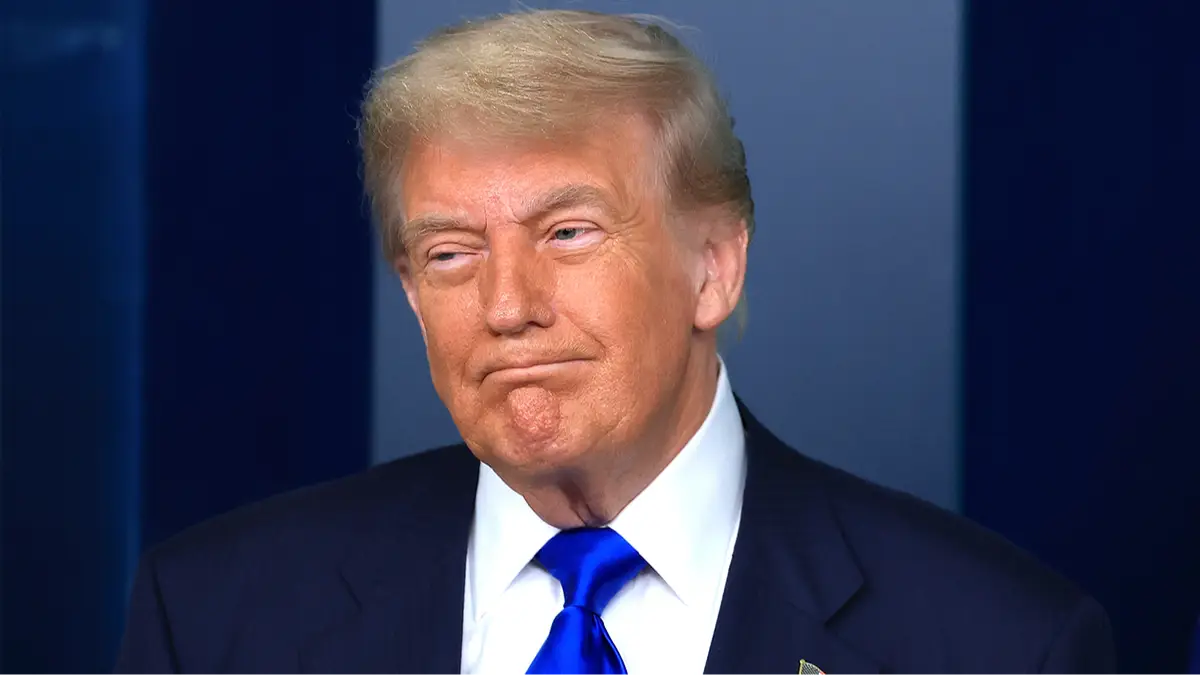

An expert has predicted the five items that may end up being cheaper in the long term after Donald Trump's tariffs take effect on August 1.

When Trump was inaugurated as the 47th president of the US in January, he set about placing heavy levies on some of America's most vital trading partners - Canada, Mexico and China, before then implementing taxes on imports.

Subsequent trade deals have been made with nations such as the UK, but it's expected that the tariffs - which come into effect in August - will see some items jump in price.

However, while much of the focus is on what will become more expensive, there are some items that are predicted to drop in price, especially in the long term, as domestic production stabilizes.

Advert

GOBankingRates explains that some items could become cheaper, in part due to a reduced foreign competition and also due to increased production in the US.

Gas

Trump's tariffs have actually caused crude oil prices to drop, which means gas prices are expected to become more affordable for drivers.

So if you're planning on stocking up on fuel, you might want to wait as the prices are thought to be steadily declining.

According to GOBankingRares, some forecasts claim prices could fall by 15 cents per gallon.

Beef

Certain foods are expected to increase in price, especially imported goods.

The US purchased over $45 billion in food and farming products from Mexico in 2023 - with almost two-thirds of all imported veg coming from the US' southern neighbor.

However, beef industry news magazine Drovers has said that the US beef industry could become more affordable due to lack of competition from imported meat.

According to predictions, this tight supply of US beef could empower farmers to improve prices.

Timber

Trump signed an order calling for a 25 percent increase in timber production, but according to the National Association of Home Builders, the effects of this could take years.

However, it's still a step in the right direction, and could lead to lower costs for consumers.

"The U.S. does not currently produce enough lumber to meet domestic demand (the U.S. uses 50 billion board feet annually but only produces 35 billion board feet)," said NAHB.

"This new development will help the nation move in the direction of self-sufficiency. However, due to logistical issues and the long time to ramp up sawmill production, it is projected to take months, if not years, before the market feels any impact from this action."

Furniture

Roughly 75 percent of all furniture sold in the US is produced overseas, according to the Alliance for American Manufacturing.

Large US manufacturers will see a reduction in import competition, which could lead to more stable prices for US-made, wooden furniture.

Clothing

American-made clothing could end up being more affordable, if the industry experiences a significant boost.

While the new tariffs will impact prices of imported clothing and textiles, lack of competition in the domestic industry could see clothing made in the US more reasonably priced in the long term.

Earlier this year, Apollo Global Management's Torsten Sløk, who works as the investment giant's chief economist, warned the government that its tariffs could trigger a recession, however he seems to have now changed his opinion.

Taking to his blog for Apollo Academy on June 21, Sløk explained his change of heart.

He wrote: "As we approach the Trump administration’s self-imposed 90-day deadline for trade deals, markets are starting to speculate about what comes next. The longer uncertainty remains elevated, the more negative its impact on the economy, as shown in the chart below.

"Maybe the strategy is to maintain 30 percent tariffs on China and 10 percent tariffs on all other countries and then give all countries 12 months to lower non-tariff barriers and open up their economies to trade.

"Extending the deadline one year would give countries and US domestic businesses time to adjust to the new world with permanently higher tariffs, and it would also result in an immediate decline in uncertainty, which would be positive for business planning, employment, and financial markets."

Sløk continued: "This would seem like a victory for the world and yet would produce $400 billion of annual revenue for US taxpayers.

"Trade partners will be happy with only 10% tariffs and US tax revenue will go up. Maybe the administration has outsmarted all of us."

Topics: US News, Money, Donald Trump, Politics