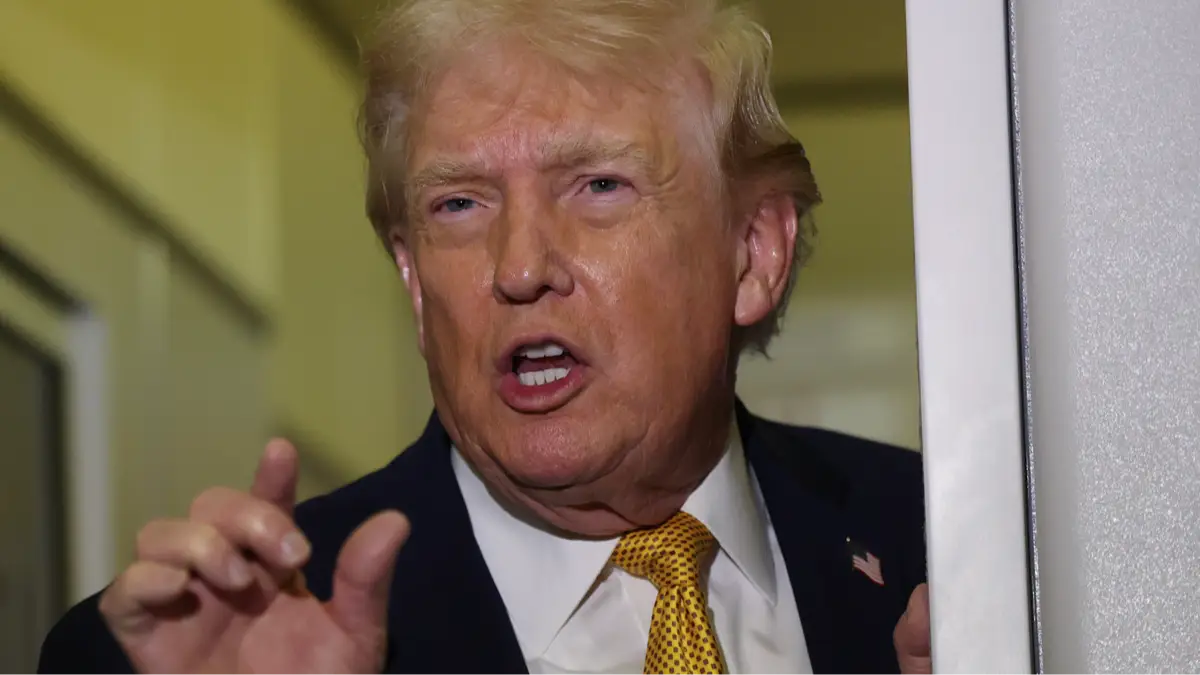

Donald Trump wants to make a huge change to credit cards to avoid Americans being 'ripped off' by companies - though it might not be so simple.

Interest rates in America have long been skyrocketing. There was a particularly dramatic jump between February 2022 and August 2023 when rates went from around 16.17 percent to 22.7 percent, data from Macro Trends shows.

But the hike didn't stop there. The following year, interest rates reached more than 23.37 percent. Fortunately, this has since come down slightly and, as of November 2025, rates were at 22.3 percent.

However, all this could change by the end of the month if President Trump gets his way.

Advert

In an announcement recently shared on Truth Social, the POTUS pledged to cap interest rates to just 10 percent for 12 months so that US citizens will no longer be 'ripped off'.

What has Trump said?

Trump wrote: "Please be informed that we will no longer let the American public be 'ripped off' by Credit Card Companies that are charging Interest Rates of 20 to 30%, and even more, which festered unimpeded during the Sleepy Joe Biden Administration. AFFORDABILITY!"

Trump continued: "Effective January 20, 2026, I, as President of the United States, am calling for a one year cap on Credit Card Interest Rates of 10%. Coincidentally, the January 20th date will coincide with the one year anniversary of the historic and very successful Trump Administration."

Trump echoed similar sentiments in his 2024 campaign when he promised Americans that his administration would 'put a temporary cap on credit card interest rates'.

However, it might not be so simple.

How 10 percent interest rates might backfire

While the idea of getting lower interest rates sounds like a good thing, the banking industry has warned that the move could actually hurt consumers in the US.

The Bank Policy Institute, American Bankers Association, Consumer Bankers Association, Financial Services Forum, and Independent Community Bankers of America said in a joint statement: "We share the president’s goal of helping Americans access more affordable credit.

"At the same time, evidence shows that a 10% interest rate cap would reduce credit availability and be devastating for millions of American families and small business owners who rely on and value their credit cards, the very consumers this proposal intends to help."

They added: "If enacted, this cap would only drive consumers toward less regulated, more costly alternatives."

In simpler terms, banks may enforce stricter lending standards if Trump's 10 percent interest rates come into play, making it harder for working-class Americans with lower credit scores to get credit cards.

Topics: Donald Trump, US News, Money, Business, Truth Social