The US Department of Education will resume collecting repayments of defaulted student loans in a matter of days.

On April 21, the US Department of Education announced its Office of Federal Student Aid (FSA) will resume collections of its defaulted federal student loan portfolio.

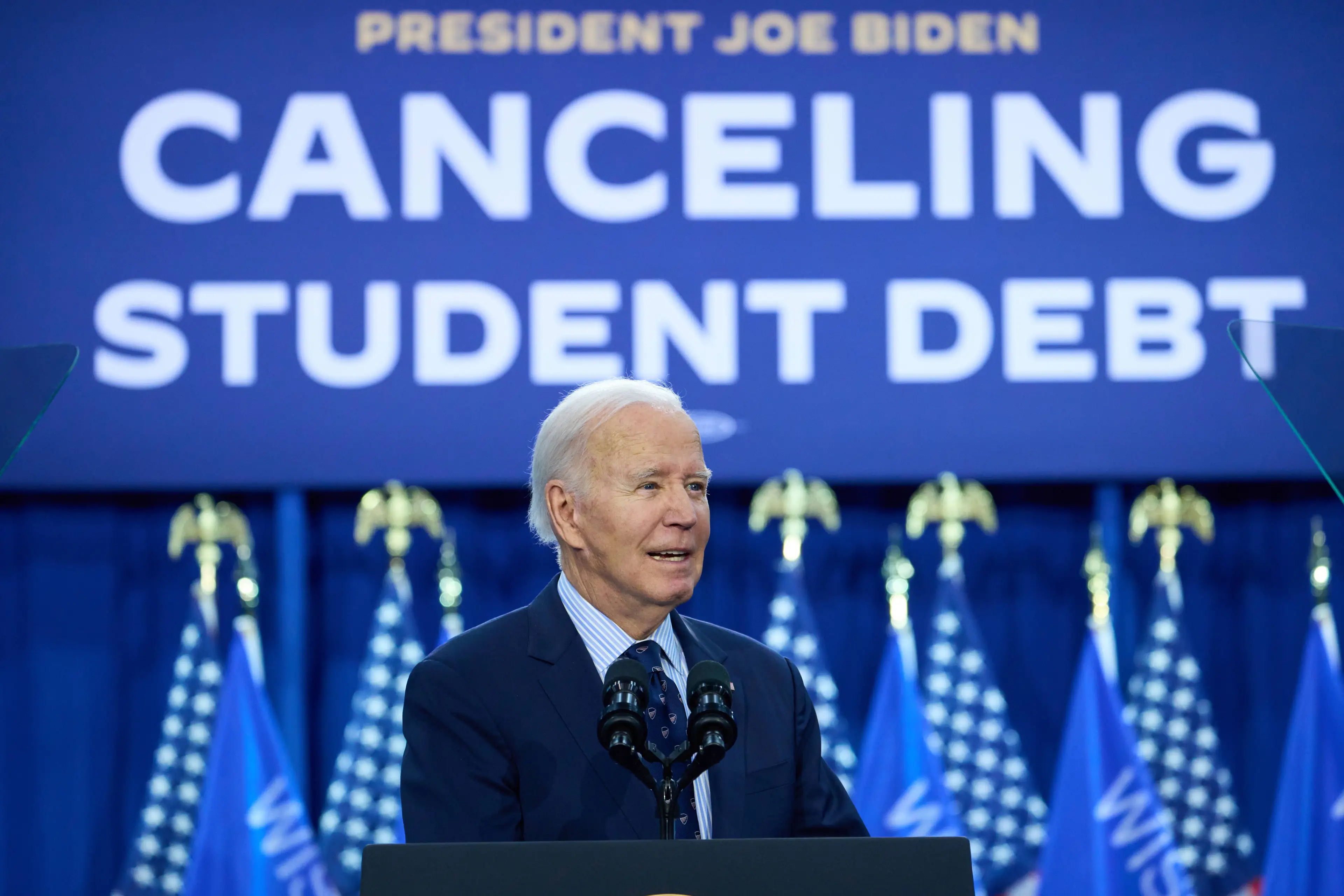

The department hasn't been collecting on default loans since March 2020 when Donald Trump paused collections amid the coronavirus pandemic, with Joe Biden later extending the pause several times.

On May 5, around 1.8 million borrowers of student loans will subsequently be moved into repayment plans, and those who are already in default?

Advert

Well, the five million plus in default who are unable to pay up when the department comes knocking to collect, the repayments will face some pretty severe consequences.

The Department of Education announcement via education secretary Linda McMahon

In an op-ed for The Wall Street Journal, education secretary Linda McMahon condemned former president Biden for 'dangling the carrot of loan forgiveness in front of young voters,' subsequently seeing the Education Department 'allow students to rack up a massive debt that is now long past due'.

She argued: "Between 2021 and 2024, federal student-loan debt increased by more than $60 billion a year, while the department manipulated repayment plans and forgiveness policies until only 38 percent of the student-loan portfolio was in repayment. This is unsustainable for both students and taxpayers."

Announcing the 'end of this dishonest and irresponsible policy,' McMahon revealed plans to 'conform to the department's repayment options to federal court decisions and end the Biden-era practice of zero-interest, zero-accountability forbearances that are pushing borrowers into loan delinquency and default'.

Should borrowers be unable to pay back their loan in the repayment plans they'll be moved into, they risk their credit scores going 'down'.

"And in some cases their wages automatically garnished," McMahon added.

But how many people will actually be impacted?

How many defaulted borrowers there actually are

A press released issued by the US Department of Education on April 21, states as of that day, '42.7 million borrowers owe more than $1.6 trillion in student debt'.

Of those, 'more than five million borrowers have not made a monthly payment in over 360 days and sit in default—many for more than seven years—and four million borrowers are in late-stage delinquency (91-180 days)'.

It explains: "As a result, there could be almost 10 million borrowers in default in a few months. When this happens, almost 25 percent of the federal student loan portfolio will be in default."

So what happens next if you're in default?

What happens next on May 5 for defaulted borrowers

Well, defaulted borrowers will receive 'email communications from FSA over the next two weeks making them aware of these developments and urging them to contact the Default Resolution Group'.

Defaulted borrowers then have a series of options: 'make a monthly payment, enroll in an income-driven repayment plan or sign up for loan rehabilitation'.

It adds: "Later this summer, FSA will send required notices beginning administrative wage garnishment."

It resolves: "FSA intends to enlist its partners – states, institutions of higher education, financial aid administrators, college access and success organizations, third-party servicers, and other stakeholders – to assist in this campaign to restore commonsense and fairness with the message: student and parent borrowers – not taxpayers – must repay their student loans. There will not be any mass loan forgiveness. Together, these actions will move the federal student loan portfolio back into repayment, which benefits borrowers and taxpayers alike."