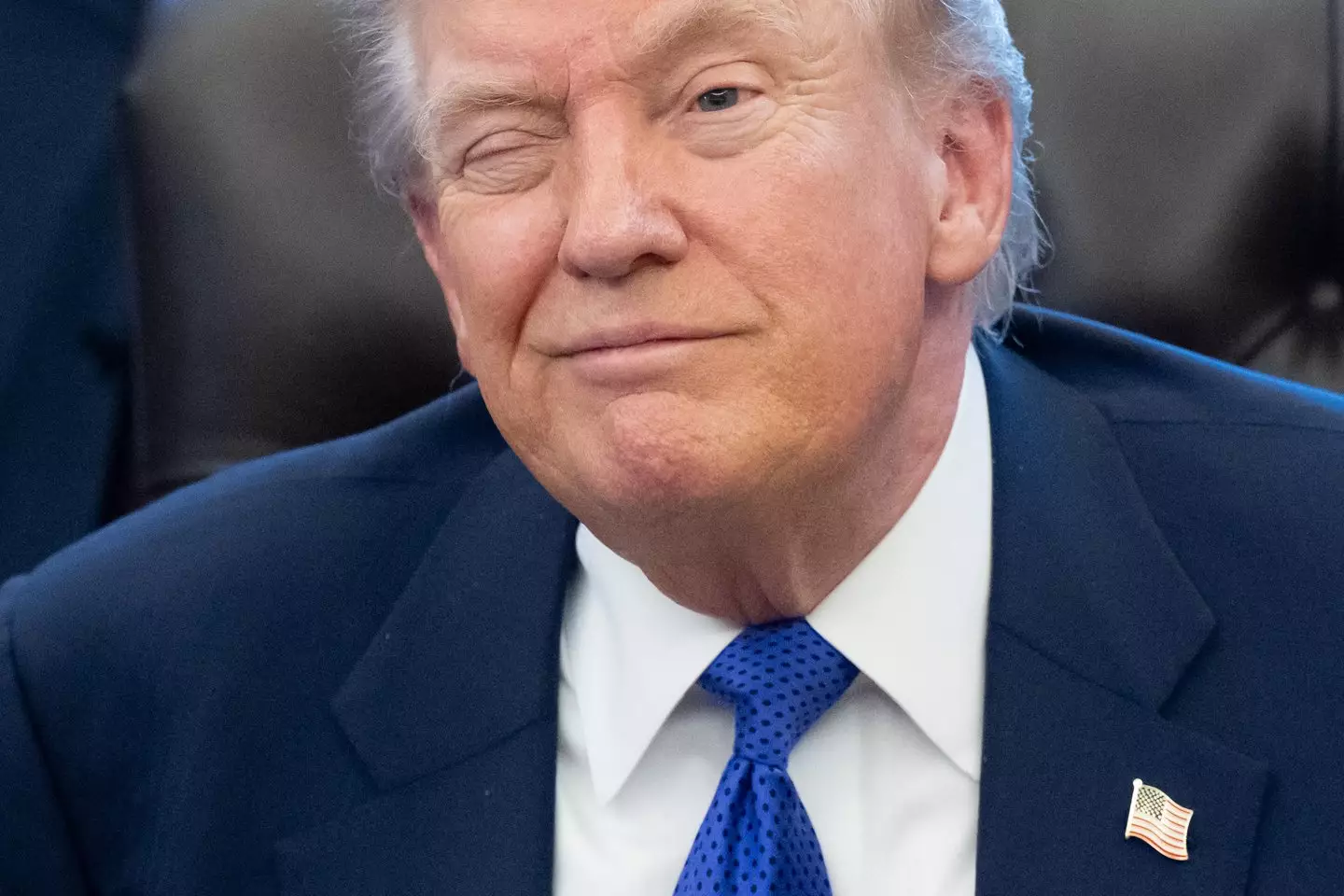

Donald Trump has given his reason as to why it's fine that the taxpayer funds his $10 billion lawsuit against the IRS.

The president defended his plan to sue the Internal Revenue Service (IRS) and the Treasury Department for $10 billion, a lawsuit he said he is starting over the leaking of his tax information in 2020.

According to the BBC, the Trump family has accused them of failing to prevent the disclosure of 'confidential, personal financial information' by a contractor, Charles 'Chaz' Littlejohn, who is currently serving a five-year prison sentence after pleading guilty to leaking the disclosure to US news outlets, like the New York Times and ProPublica.

The lawsuit further claims the leaks 'unfairly tarnished' the business and public reputations of Trump and his sons, Donald Trump Jr and Eric Trump, alleging that they'd also suffered financial harm.

Advert

In a press conference on board Air Force One, Trump was asked if it was 'fair' for American taxpayers to pay for his lawsuit as he is essentially suing his own government, to which he responded that he plans to give '100%' of whatever money he receives to charity.

“Well, anything I win I’m going to give 100% to charity,” he said.

The journalist continued to push the question, pointing out: “But that still takes it from the American people…”

But Trump was adamant, replying: “No, because they give money to charity. They (the government) give away 40 billion dollars to charity a year.”

He continued: "When they go on to release your tax returns, it's totally illegal. People go to jail for that and they've already found the person who did it, as you know, they got in big trouble."

He reiterated that any money he'd receive would go to 'good and respected charities', something which he also told NBC's Nightly News anchor, Tom Llamas.

"And any money that I win, I’ll give it to charity, 100% to charities, charities that will be approved by government or whatever," he said.

Legal experts have said that Trump does have a legitimate claim against the IRS over his tax records.

The disclosure of his tax information violated IRS Code 6103, one of the most stringent confidentiality laws in US federal law. Its aim is to support people whose tax information has been leaked, and it has a minimum of $1,000 per disclosure of the information.

However, while they have said that Trump has a grievance with the IRS over the leak, legal experts have expressed doubt about the size of the damages he is seeking and questioned his decision to pursue the case.

“What’s the true harm that he [Trump] is still experiencing that requires this amount of taxpayer money at this juncture?” Lisa Gilbert, co-president of Public Citizen, told NBC News.

In a statement to NBC News, Trump's private attorneys said: "The IRS wrongly allowed a rogue, politically-motivated employee to leak private and confidential information about President Trump, his family, and the Trump Organization to the New York Times, ProPublica and other left-wing news outlets, which was then illegally released to millions of people.

"President Trump continues to hold those who wrong America and Americans accountable."

UNILAD has reached out to the IRS and the Treasury Department for comment.

Topics: Money, News, US News, Donald Trump