Experts have expressed fears over the economic repercussions of Trump's attack on Iran over the weekend as tensions continue to escalate in the Middle East.

The world is still reacting to Trump's shock move to launch strikes at three of Iran's key nuclear facilities on Saturday night (June 21), dropping 14 powerful 'bunker buster' bombs on the sites amid the nation's ongoing conflict with Israel.

After Iran vowed the US will be facing 'everlasting consequences' for its attack and a 'decisive response' will be coming, the country today (June 23) launched missiles of its own on US air bases in Qatar and Iraq.

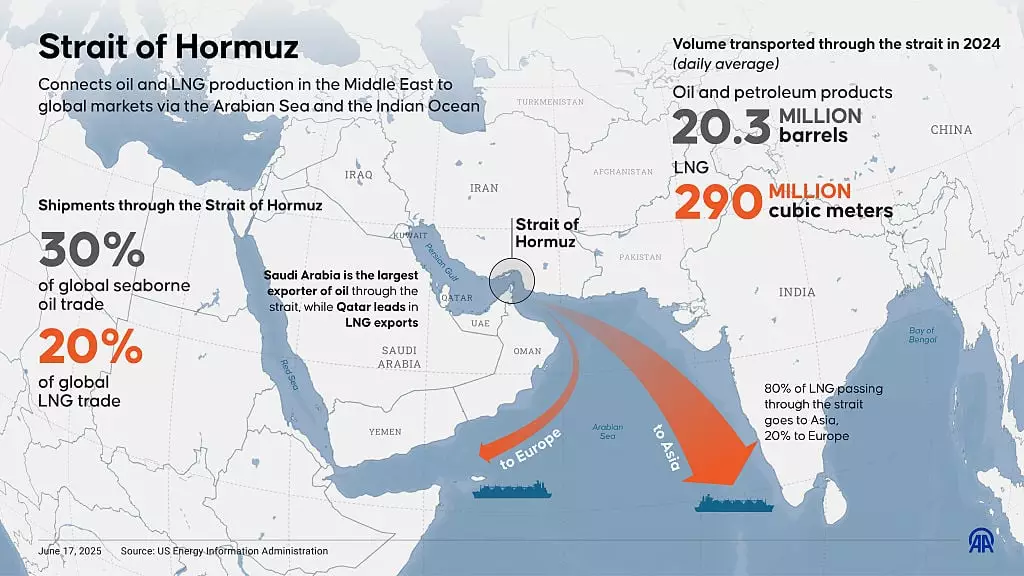

It is not yet known what will happen next, but there's no doubt one that one of the most damaging strategies Iran could use is the control is has over the northern side of the Strait of Hormuz - a stretch of water between Persian Gulf and the Gulf of Oman which 20 percent of the world's supply of oil travels through.

Advert

Calls from within Iran have already grown for the Strait to be shut down or heavily restricted, with Iran’s state-owned media reporting that the country's parliament backed the move.

However, US Secretary of State Marco Rubio warned shutting down the Strait would be 'economic suicide' for Iran, particularly when it comes to relations with China, which is Iran's top trading partner.

Still, rumblings alone of the move has got experts seriously worried as they explain how gas prices could be affected by the conflict if Iran did choose to disrupt the Strait.

As of Sunday evening, oil prices hiked while stock futures fell, indicating investors remain concerned over the impact of the US' attack on Iran.

It was yet another blow for the US stock market, which was only just recovering from the impact of Trump's slew of tariffs earlier this year.

US and global benchmark oil prices opened up at four percent on Sunday evening, having been at three percent the previous week when Israel launched its large-scale attack and Iran subsequently launched retaliatory attacks.

Stocks were also down on Sunday, but what does this all mean in terms of money?

Well, according to Andy Lipow, president of the consulting firm Lipow Oil Associates, gas prices could go up by 75 cents per gallon.

In a note to clients on Sunday, he warned: “Should oil exports through the Strait of Hormuz be affected, we could easily see $100 oil or an increase in US gas prices by 75 cents per gallon."

Meanwhile, experts over the weekend warned that oil prices might to rise by about $5 per barrel.

Oil markets expert Patrick De Haan has also given his take on potential price hikes, writing on Twitter: "Incorrect/false rumors talk about an incoming massive spike to #gasprices. this is erroneous. incorrect on the highest order. I am expecting the national average price of gasoline to rise an additional 10-30c/gal in the days ahead as of now."

Of course, the full extent to which gas and oil prices are affected will all be down to what Iran does next and if if chooses to close the Strait of Hormuz.

However, experts say that such a move could only prove to antagonize and risk further military force from the US and its allies, and therefore ramp up the already escalating conflict.

Bob McNally, president of consulting firm Rapidan Energy Group and former energy adviser to George W. Bush, said: "It’s possible they will decide the only thing that can dissuade President Trump is the fear of an oil price spike.

“They have to actually create that fear.”

Topics: Donald Trump, Iran, Israel, Money, Politics, US News, World News