President Donald Trump’s decision-making has had a shocking impact on the US stock market in the past six months.

It's been half a year since Trump returned to the White House for his second term and in that relatively short time, the US economy and stock market has been on quite a rollercoaster.

While on a mission to 'make America rich again', the Trump administration has slashed federal budgets, imposed tough tariffs on its global trading partners and proposed mega tax cuts for the wealthy.

The US economy has grappled with volatility and inflation ever since, most recently hiking the consumer price index (CPI) on everything from everyday goods like food and clothes to toys, appliances and utility bills.

Advert

Here's a quick lowdown on everything Trump has done that's got us into this position.

Trade and tariffs

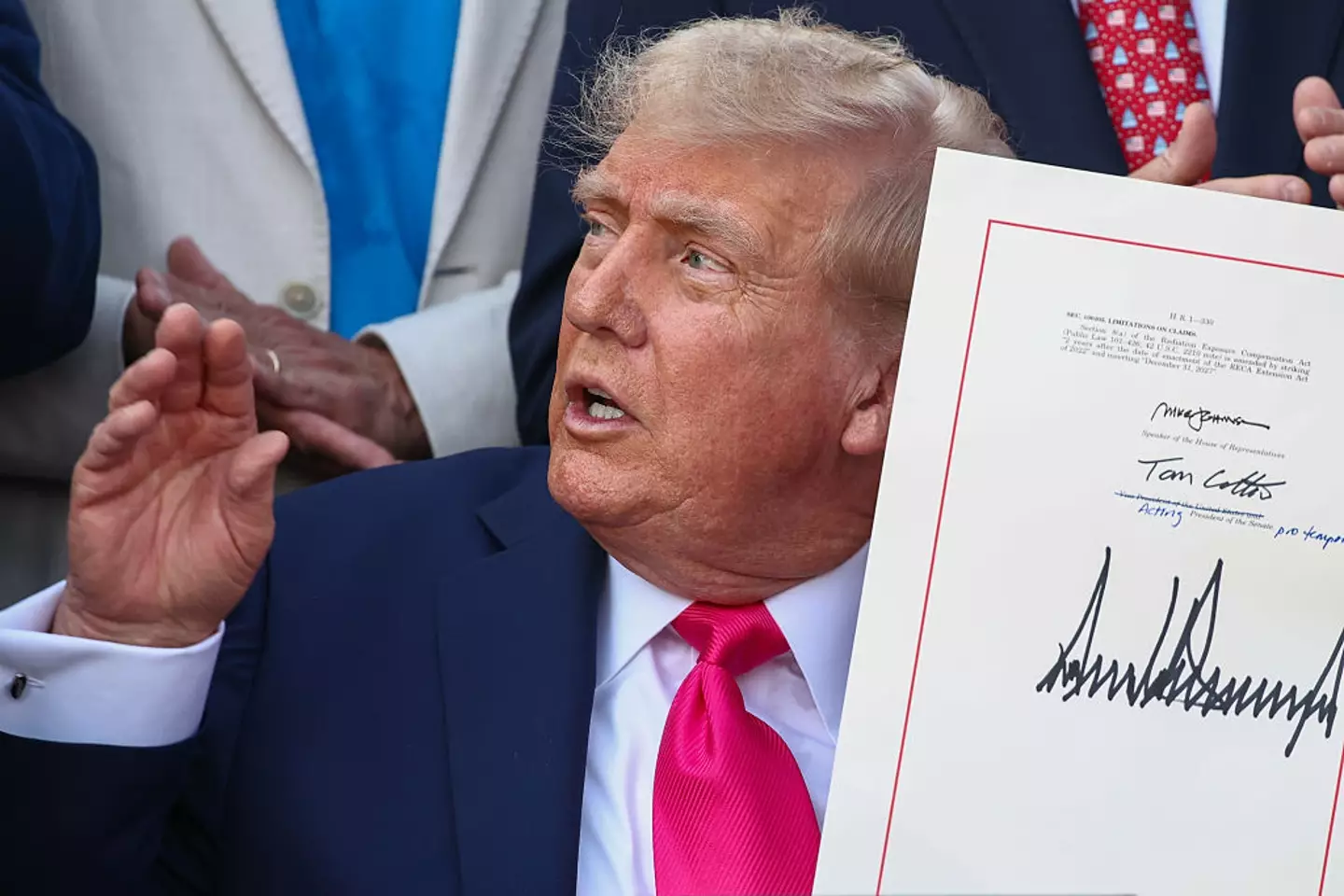

Cast your mind back to April 2 and you might remember the president parading a large board with a list of tariff hikes for the US global partners, all while shouting it's America's 'Liberation Day.'

On his tariffs vision board included a minimum 10 percent on goods from all trading partners, with others like China, Japan and the European Union facing even higher rates.

However, the rollout was stalled by delays and reversals as global partners hit back, igniting market turbulence and fears of a recession beyond the horizon.

As JP Morgan noted, by the end of April that the 'uncertainty' and 'general thrust' of Trump's policies 'now depressing business sentiment, which will directly weigh on spending and hiring.'

By May, the US and China agreed to step off the gas for 90 days to de-escalate the tension and Trump struck a trade deal with the UK, followed by Vietnam earlier this month.

Now, the deadline for trade agreements elsewhere has been pushed back to no later than August 1 - and the POTUS has said new reciprocal tariffs could apply to Brazil (50 percent), Canada (35 percent) and the EU and Mexico (30 percent each).

The US stock market

According to financial advisors and economists, the real issue lies in the uncertainty of it all.

The US stock market plummeted in late April, in line with the tariffs debacle, but appears to have recovered - for now at least.

The MSCI USA index has increased around 20 percent, as per HL, but remains down by six percent since Trump took to the White House.

However, the Trump administration remains confident with its vision, even if the stock market is moving with caution.

The president has said higher taxes will boost homegrown businesses from global competitors, increase manufacturing and jobs and rake in additional revenue, all while shrugging off warnings that his measures will see Americans straddled with higher prices at the checkout.

Instead, the White House claims companies and foreign exporters will absorb the costs, though some economists have already disputed this and claim the US economy has so far weathered the storm because firms stocked up on goods.

US inflation

Inflation leapt in June in response to Trump's tariffs, pushing up prices on many everyday goods.

According to the BBC, consumer prices increased 2.7 percent in the year to June, up from 2.4 percent in May.

The Labor Department said this was the fastest increase since February, with higher energy costs and housing, like rent, driving the hikes.

As economists long warned, some firms have already transferred the costs of Trump's new taxes on imports - for instance, coffee rose 2.2 percent from May to June, citrus fruit by 2.3 percent, toys 1.8 percent and appliances 1.9 percent. Clothing also rose 0.4 percent.

On the other hand, this has arguably been offset by a decline in prices on items like cars, airfare and hotel bookings.

The 'Big Beautiful Bill'

Trump's so-called 'One Big Beautiful Bill Act' proposes several tax cuts, funded by slashing Medicaid and food benefits all while simultaneously boosting defence, immigration enforcement and border spending.

However, some are not so convinced it will live up to Trump's expectations, most notably contributing to the US budget deficit, as raised by Trump's former 'first buddy' Elon Musk.

“Utterly insane and destructive,” Musk stated about the Act. “It gives handouts to industries of the past while severely damaging industries of the future.”

The former head of the Department of Government Efficiency (DOGE) also said it would see Americans grapple with 'crushing' debt.

And he's not the only one, as a report by the nonpartisan Congressional Budget Office published yesterday (July 21) said it will add $3.4 trillion to the national debt in the next 10 years all while starving some 10 million more people from health insurance.

Topics: Donald Trump, Tariffs, Politics, US News, Money, Elon Musk