In what must have been an infuriating conversation, a financial expert had to listen to a couple complain about how they are struggling despite bringing in over 10k a month.

You read that right, $10,000 a month. How do you bring in that much money between the two of you and still find time to moan that you are struggling money-wise.

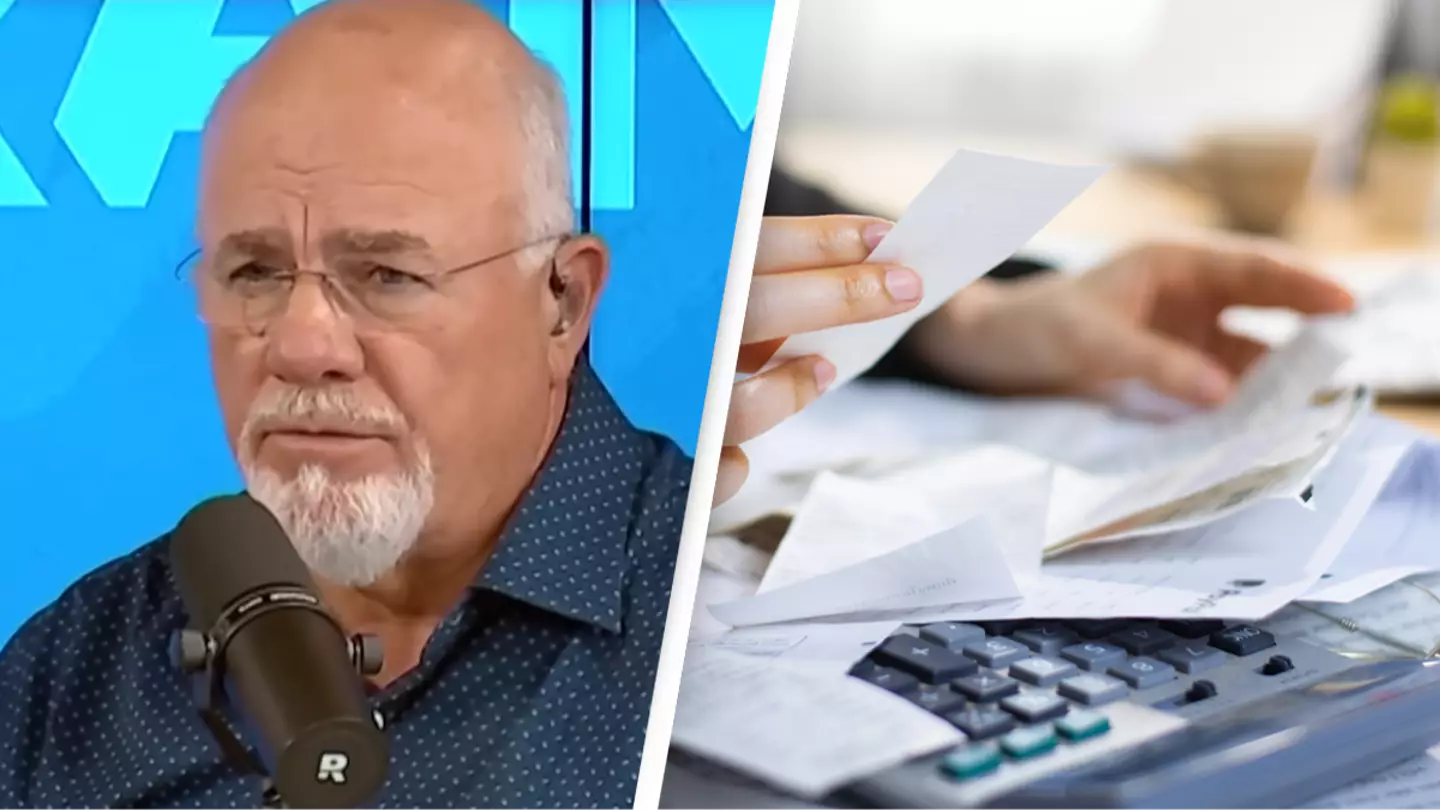

These are pretty much the same questions radio personality and financial guru David Ramsey asked as he spoke to the couple in a call in.

Ramsey has built up a reputation as being brutally honest with the people who call in, often telling them to trim the fat in their spending and be far more frugal.

Advert

In a recent call, the woman in the relationship, Alyssa, said that she and her husband do not contribute to their retirement and only have $3,000 in savings.

She also said that they are in $138,000 in debt. Yikes.

However, after some prying, Ramsay found out that things aren’t exactly how Alyssa was making out.

He discovered between them the couple make around $140,000 a year, significantly more than the average American.

He then encouraged her and her husband to follow his advice to start paying off the debt $5,000 a month.

He said: “You know what I'm worried about? You make $130,000 a year and you're freaking broke. That's what I'm worried about.”

After sensing some hesitance, he pressed harder and insisted it was imperative the couple focus on clearing their debt.

Alyssa continued to resist and argued that she was worried about ‘catastrophic expenses’ due to the fact she is self employed as a mental health care therapist and her husband is in construction.

She even tried to argue that she didn’t want to do it due to fears surrounding her nine-year-old daughter.

Saying she worried that setting aside money to pay off her debt would make her worry her daughter isn't secure. What. Is. That. Logic...

You would think when your debts far surpass $100,000 you would do everything in your power to lower the debt, especially if you have children.

Alyssa then tried to argue that they were saving money for emergencies... something Ramsey pointed out they weren’t doing because she said they only had $3,000.

In the end, Ramsey hammered home just how important it was to chip away at the debt. You wouldn’t expect to have to tell them that, but hey ho, if it works that is all that matters.

Ramsey did admit that it would be difficult to get used to, but it was very important for them to do now.