I don't know about you, but I sometimes struggle to put any of my pay check away each month - however this woman was stashing away 75 percent of it.

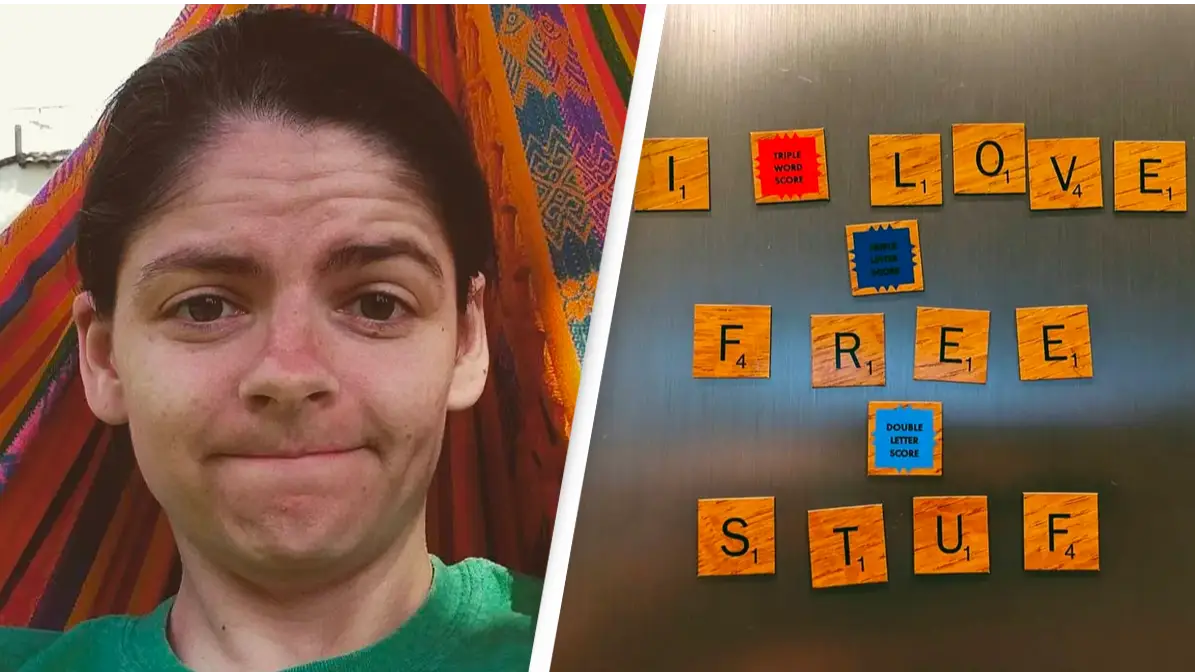

Gwen Merz saved a staggering $200,000 by the time she was 27.

Making it even more impressive, she did it over the period of five years.

But, as you'd expect, saving such amounts of cash over this time came with its sacrifices.

Advert

One of Gwen's biggest drivers for saving was to be a member of Financial Independence, Retire Early (FIRE).

Her starting salary was $65,000, and Gwen - an IT worker - managed to squirrel away 78 percent of it every month.

But after a few years of excessive saving, the now 33-year-old found that it wasn't realistic to keep going on forever.

In fact, it was negatively affecting her life in some ways; her job progression in particular.

"I didn’t really realize the cost that I was incurring in my career, as I was not wanting to go out and do happy hour or go do lunch with my coworkers," she penned in an op-ed for Business Insider.

Gwen went on: "That kind of off-site networking really is where a lot of connections get made.

"They come in handy later when you’re like, 'Hey, I’m up for this promotion. Would you put in a good word for me?' If you don’t have that kind of connection, they’re like, 'I don’t know about that.'"

Elsewhere, Gwen neglected her dating life as well.

"I never really found a partner that had the same mindset when I was dating," she shared.

"So that made being single really hard - by not wanting to spend any money on it, because it came off as cheap and controlling."

Gwen added: "I had opinions on how my partners were spending their money, and people don’t really appreciate that."

While it came with its hardships, she insists that she doesn't have any regrets about her extreme budgeting period.

"I think that was the perfect time in my life to do that, and see what I liked and what I didn't like," she wrote.

"It definitely benefited me in the long run. I am much better off than I would be otherwise if I hadn't saved up all that money."

Now, instead of putting away a large majority of her pay cheque, Gwen now saves 10 percent of it for her 401(k) instead.