If you own a company, you’re pretty much guaranteed to be accepted when applying for any product right? Well, apparently not.

Technology has come a long way in such a short amount of time, from cool daily gadgets making your life easier to established brands entering new territories.

Which is why when iPhone manufacturer Apple decided to try its hand at introducing a credit card in 2020, it wasn’t what fans were expecting the tech leader to produce.

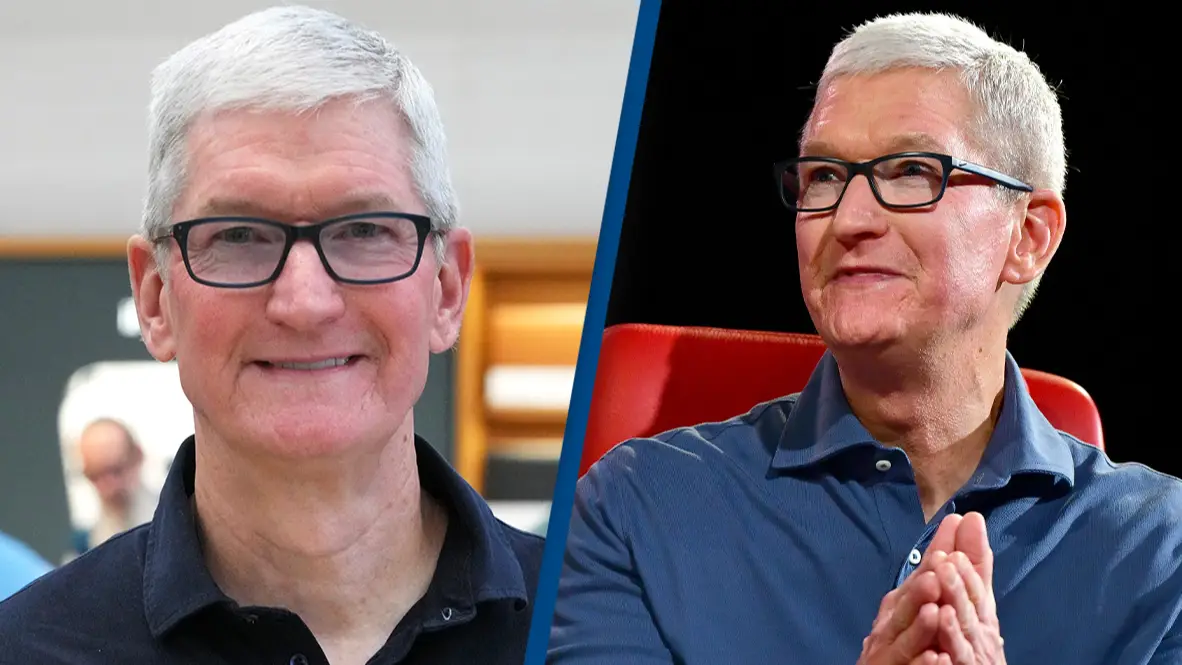

But CEO Tim Cook found that laying his hands on his own branded card wasn’t as straightforward as you’d think.

Advert

Instead, the multi-billionaire was rejected for his card in partnership with US bank Goldman Sachs due to his risk of fraud.

When first starting the endeavour to create an Apple credit card, the CEO’s account was flagged by credit bureaus due to it checking boxes which would usually result in the denial of an application.

As reported by The Information, Cook is high-risk for scams and ID impersonations which led to his rejection on his own card, regardless of the fact that he was the real deal.

But thankfully, Goldman took control and rectified the situation for the tech leader to receive his company's credit card.

Though the two companies are currently partners on the Apple Card, there has been rumours that Goldman might try to dip and run, as reported by The New York Post.

Savings account customers accused Apple of holding their money ‘hostage’ due to delays in withdrawing funds.

Apparently, there are also concerns with the economy and the increased interest rates which has made the partnership cost more and being less profitable.

According to Bloomberg, Goldman had to fork out $1 billion in pre-tax losses from its group of businesses which are involved in managing the card.

The card was initially a great idea, as users could set one up from an iPhone within minutes with a maximum balance of $250,000.

Savers are also able to withdraw any amount at any time, without limits which beats the current cap on many US banks, which is six per year.

Sources told Forbes that when the card was released in April 2020, around 240,000 accounts opened within the first week and $400 million deposits on its first day.

But now, with the cost of living rocketing around the world, things are looking distinctly less rosy.

UNILAD has reached out to Apple and Goldman Sachs for comment.

Topics: Apple, News, US News, Technology