Netflix has confirmed it has entered a 'definitive agreement' to acquire Warner Bros. Discovery (WBD).

Already the world's largest streaming service, Netflix proved victorious in a competitive bidding process against Paramount Skydance and Comcast.

A 'definite agreement,' is the final, legally binding contract that formalizes a business deal.

In a statement shared on Friday (December 5), Netflix confirmed the acquisition would be not complete until after Q3 2026.

Advert

Warner Bros Discovery, which owns channels including TLC, Cartoon Netflix and Boomerang, put itself up for sale in October after interest from several parties.

The industry-shaking deal is valued at a whopping $82.7 billion enterprise value, which is the total cost of the acquisition, adding debt and subtracting cash.

It's worth $72 billion in equity value, which is the amount paid to shareholders in the deal. WBD shareholders will receive $27.75 per share.

Here is a breakdown of the deal, what Netflix will and won't own and what happens next.

What exactly is Warner Bros. selling to Netflix?

Netflix said that the acquisition will only happen once WBD splits into two companies.

Before the acquisition closes, WBD will separate multiple entities under a streaming and studios division, which will be sold to Netflix.

This will include:

- Warner Bros. film studios

- Warner Bros. Television

- New Line Cinema

- DC Studios

- HBO and HBO Max

- The full WB film and TV library

Netflix says it will maintain Warner Bros.’ current operations and continue theatrical releases under its new ownership.

The remaining entities will remain separate under Discovery Global and still be run by Warner Bros.

This will include:

- CNN

- TNT Sports

- Discovery networks

- Free-to-air European channels

- Discovery+

- Bleacher Report

What happens next?

In its statement, Netflix confirmed the transaction was 'unanimously approved' by the Boards of Directors of both Netflix and WBD.

But there are still multiple hurdles that need to be cleared for the deal to go through.

In addition to the completion of the separation of Discovery Global, the deal will need to receive regulatory approvals, approval of WBD shareholders and 'other customary closing conditions.'

The transaction is expected to close in the next 12 to 18 months.

What has Netflix said about the deal?

Netflix claims the deal will create a 'stronger entertainment industry' by significantly expanding US production capacity.

It also claims consumers will get more choice and value through access to a richer film and TV library, while Netflix can refine its plans and 'expand viewing options.'

For creators, the merger opens up more opportunities to work with major franchises and reach larger global audiences.

Not everybody agrees, though.

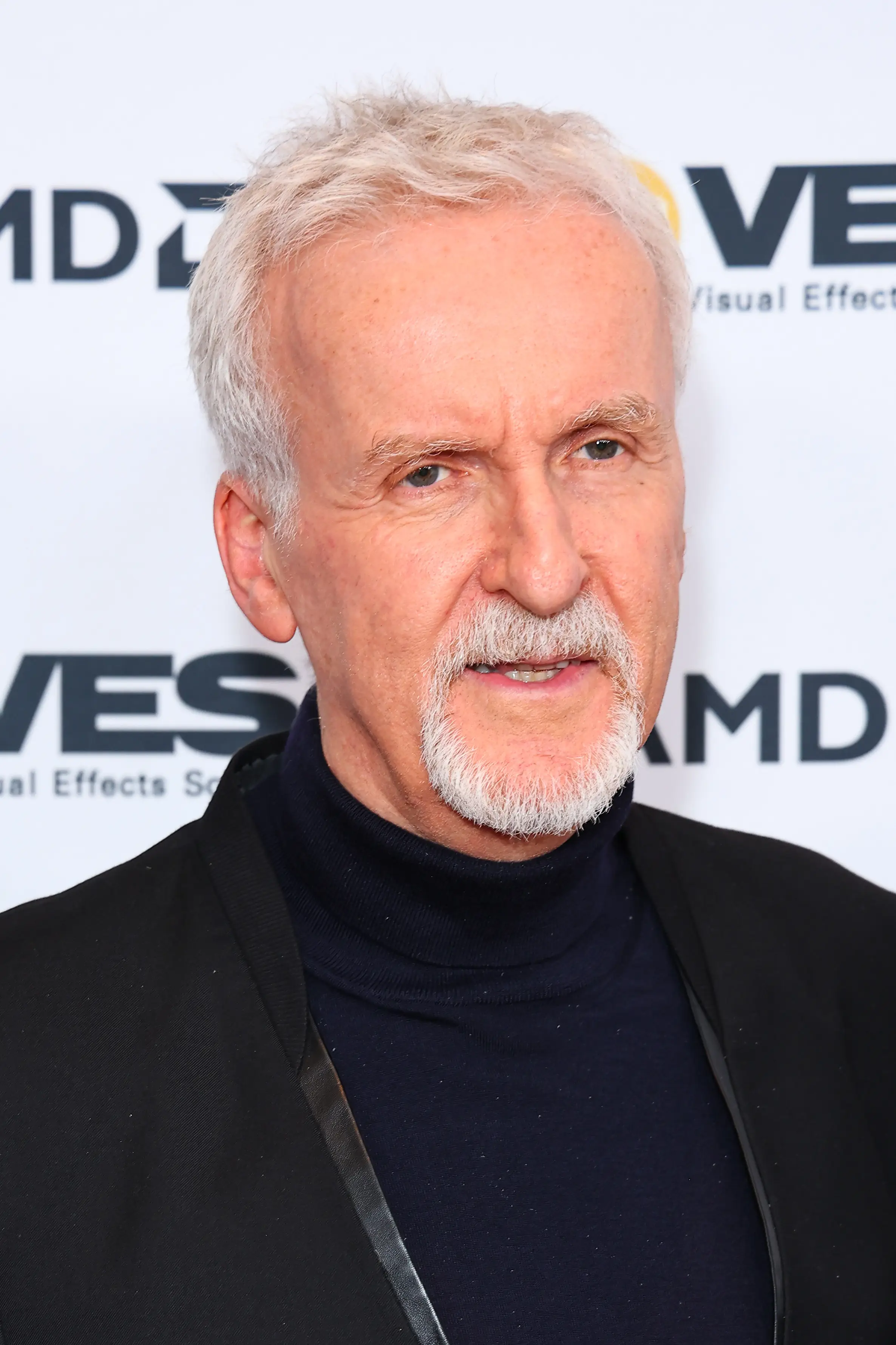

Movie director James Cameron hit out at the possibility of a Netflix takeover, branding it a 'disaster,' as per IndieWire.

On Matt Belloni's The Town podcast last week, he criticized Netflix CEO Ted Sarandos for previously dismissing theatrical cinema as 'dead.'

He argued that Netflix undermines cinema by giving prestige films only brief theatrical runs to qualify for Oscars instead of committing to full releases.

The Titanic director also dismissed Sarandos’ promise to honor Warner Bros.’ theatrical plans, calling it 'sucker bait' and accusing Netflix of offering only token one-week showings.

He said movies should be made for theaters first and that the Oscars lose meaning when they reward films without real theatrical runs.

Cameron added that if Netflix wants awards consideration, it should be required to release films traditionally, in thousands of theaters for at least a month.

Topics: Netflix, Streaming, Business, Entertainment, James Cameron