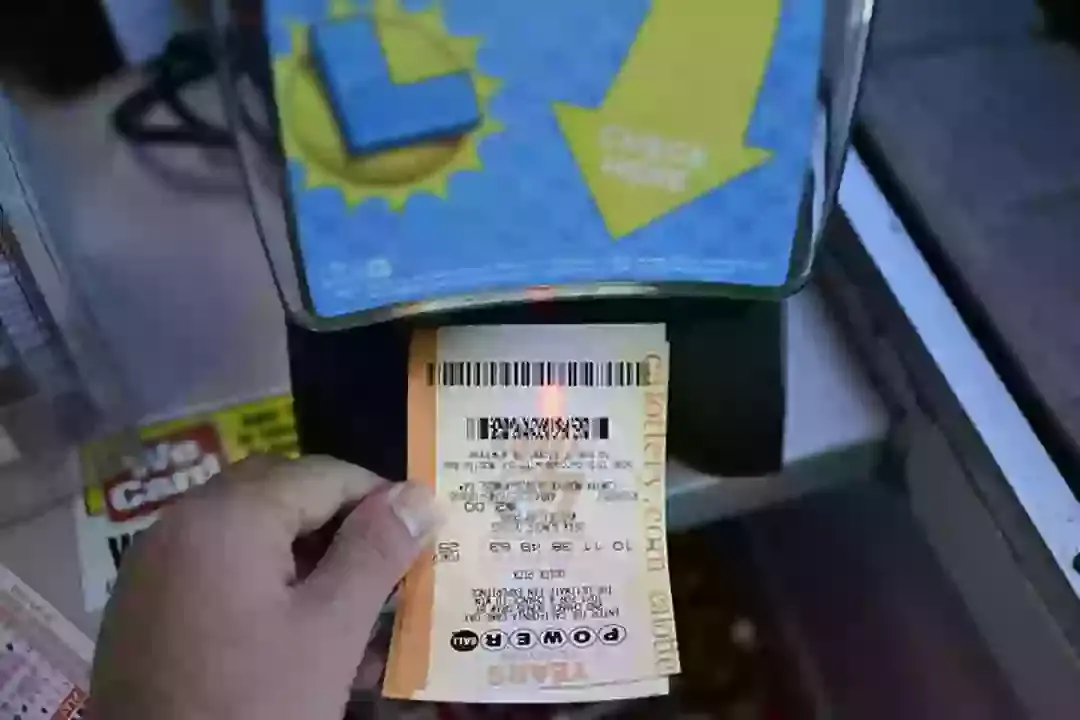

A Power jackpot of some $1.8 billion would result in a hefty tax bill for the lucky winner.

Who hasn't wondered what they would spend it all on if they won the lottery?

Some opt for extravagant spending sprees on houses, luxury yachts, and champagne.

Others might choose a more measured approach, starting by paying off things like student loans, mortgages, or healthcare debt.

Advert

Regardless of how you would spend the money, if you were to strike extremely lucky on the lotto, the first cheque you wrote probably wouldn't be to Luxury Yachts 'r' Us or Dom Perignon's wholesale department, but instead to good old Uncle Sam.

But exactly how much tax would you have to pay on the $1.8 billion, yes billion with a B, prize? Let's break it down.

It probably won't shock you that your tax bill on a prize of this size would run not just into millions, or even tens of millions.

In fact, you would be facing a tax bill of hundreds of millions of dollars.

Lottery winners often pay a tax rate of at least 24 percent on their winnings, which in this case could be a whopping $432 million, or $198.3 million depending on how you collected your prize.

That would leave you with a paltry $1.368 billion to scrape by on. Oh, the humanity.

Of course, there would also be other taxes to pay on it as well, with the prize pushing winners into higher tax brackets.

In New York, for example, lottery winnings are taxed at 10.9 percent, according to the New York lottery guidelines.

When it comes to federal taxes, single people earning $626,350 or more and married couples earning over $751,600 come into the federal tax bracket of 37 percent.

Lottery winners have two options in how they collect their prize.

Either you can choose a single lump sum payment, resulting in a lower overall payment, or a series of annual payments over a set period which would mean you would get the full prize, minus taxes.

If you were to win Saturday's mammoth $1.8 billion jackpot, the lump sum would see you take home around $826.4 million, while the annuity would see you get the full prize but spread out.

While financial advisors generally recommend the annuity option to ensure a reliable income, for most winners the temptation of that big cheque is enough for them to opt for the single payment.

The tax bill for winners of lottery prizes this big may well make them the only billionaires to actually pay their fair share of tax.