Customers at a bank have potentially landed themselves in hot water after taking advantage of an 'infinite money glitch'.

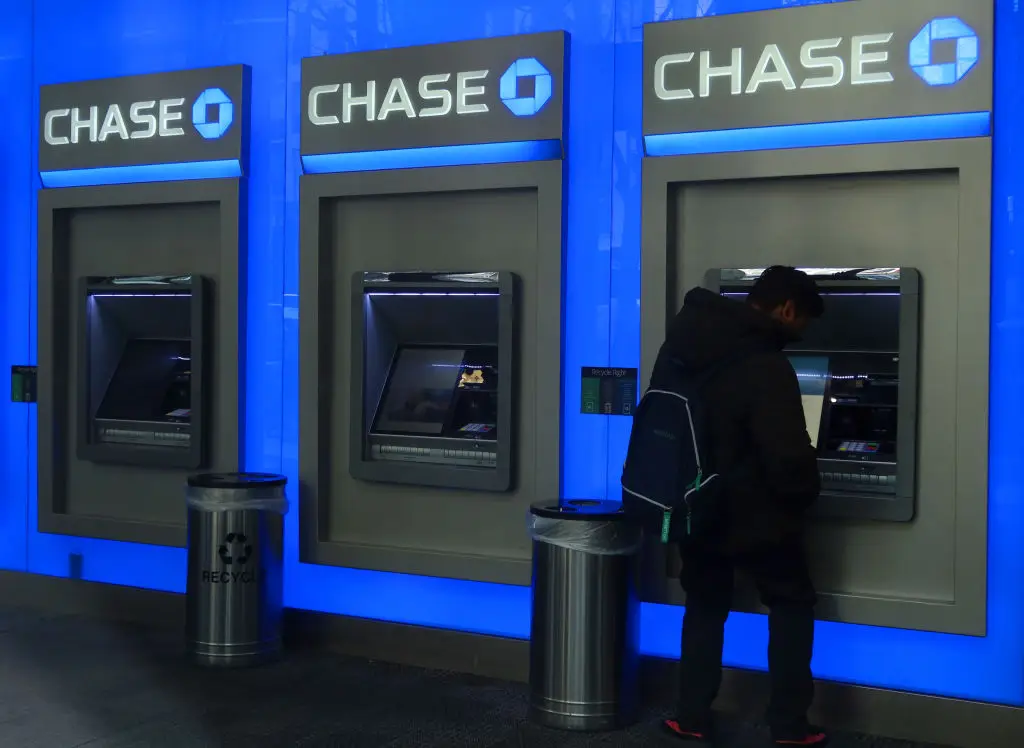

ATMs for Chase bank have developed a fault in their software which meant that they were accepting false checks as deposits in accounts.

This meant that people could deposit a false checks and withdraw the funds from the account in cash.

Advert

As the saying goes, if something sounds too good to be true then it almost always is, but that didn't stop many people not only participating in the viral 'trend', but posting themselves doing it on social media.

Needless to say, this is far from a social media trend or hack, but is actually just good old-fashioned fraud.

This means that if you do participate in this, especially if you post evidence of yourself doing it online, then you could be opening yourself up to fines and even potential jail time.

Chase bank has responded to the glitch, saying they have 'addressed' it.

A spokesperson for the bank said in a statement: "We are aware of this incident, and it has been addressed.

"Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple."

Following the bank's update and crackdown on the practice, many people who had initially posted videos of themselves spending the results of fraudulent checks are now seeing their bank balance plummet into the red.

One man showed deductions which were pending on his account.

Of these, one showed a deduction for over $7,000, and another one for a whopping $31,000.

Both of the deductions were listed on the account as being due to a deposit or ATM error.

The man rubbed his face and said: "F**k man, they really told me to tap in, the next day it was supposed to clear, but look at my account."

Another was left horrified after their account was shown to be $11,000 in the red after they participated in the 'trend'.

People were quick to jump onto social media and take the mickey out of those who had been unwise enough to do the trend.

One joked that people had got into 'generational debt to buy a nice car they'll own for two days before all their assets are seized by the bank'.

Another said: "Go ahead and spend that money now. Who told you this was going to be a safe way to get money? You don't think that this is going to be trackable?"

Others took a different approach, warning people from participating.

Among them was Jim Wang, a financial advisor on TikTok, who said: "In the case of this 'glitch,' it was just check fraud. You’re going to get in huge trouble if you do something like this."

According to the Daily Mail, in the most serious cases, check fraud against large companies can carry a sentence of over 30 years in prison and fines of over $1 million.